| CAC 40 | Perf Jour | Perf Ytd |

|---|---|---|

| 7380.74 | +0.92% | -2.15% |

| Pour en savoir plus, cliquez sur un fonds | |

| Auris Gravity US Equity Fund | 32.90% |

| Jupiter Merian Global Equity Absolute Return | 8.82% |

| Pictet TR - Atlas | 8.61% |

| AXA WF Euro Credit Total Return | 8.53% |

| Cigogne UCITS Credit opportunities | 5.90% |

| Exane Pleiade | 5.84% |

| Sanso MultiStratégies | 5.43% |

| Candriam Bonds Credit Alpha | 4.64% |

| DNCA Invest Alpha Bonds | 3.47% |

| Fidelity Absolute Return Global Equity Fund | 3.42% |

| Syquant Capital - Helium Selection | 3.35% |

| Candriam Absolute Return Equity Market Neutral | 2.81% |

| H2O Adagio | 0.67% |

| M&G (Lux) Episode Macro Fund | -1.67% |

| Vivienne Bréhat | -9.56% |

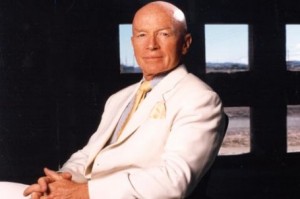

EXCLU H24: une interview exceptionnelle de Mark Mobius, le «Maître» des marchés émergents depuis plus de 40 ans...

Â

Â

Mark Mobius, Executive Chairman of Templeton Emerging Markets Group

Â

Â

Â

Frédéric Lorenzini : Name 3 markets to invest in for 2014 and 2015 ?

Mark Mobius : We think the most exciting opportunities currently lie in frontier markets, in particular Nigeria, Vietnam, and the UAE and Saudi Arabia.

Â

F.L. : Could the US go bankrupt ?

Mark Mobius : No, we think it’s extremely unlikely.

Â

F.L. : Could China overtake the US to become the world’s largest economy in 5 years’ time ?

Mark Mobius : Yes it’s quite possible, but I would say in 10 years’ time rather than 5.

Â

F.L. : Name a stock investors should have in their portfolio ?

Mark Mobius : There are too many stocks I like very much…

Â

F.L. : Where will we see the next bubble ?

Mark Mobius : It will probably take place somewhere in Africa where some markets which have tremendous growth, are attracting more and more money.

Â

F.L. : What percentage of a developed market investor’s portfolio should be made up of emerging markets ?

Mark Mobius : We suggest around 30%. Emerging markets represent 32% of the world market capitalization.

Â

F.L.: Should people trust their banker ?

Mark Mobius : When it comes to investing, it’s essential to be diversified, don’t trust your banker to do that job. Take advice from lots of different people.

Â

F.L. : Is money management more a matter of discipline or creativity ?

Mark Mobius : I would say both: discipline means looking at facts. At the same time, investors should be creative and have new ideas. Investment is all about the future, not the past.

Â

Â

F.L. : As a fund manager, what has been your biggest mistake ?

Mark Mobius : Our biggest mistake was our failure to change our attitude regarding an Indonesian stock we held many years ago. It was a popular company which many people liked. Because it was popular, we were reluctant to sell, even when things started to go badly.

Â

F.L. : How is your personal financial portfolio structured ?

Mark Mobius : One third in mutual funds, mostly my own funds; one third in property; one third in cash.

Ndlr H24: Nous avons gardé les questions et les réponses en anglais, un anglais plutôt simple à comprendre mais nous diffuserons dans les prochains jours une traduction communiquée par le service compliance du Groupe Franklin Templeton.

Mark Mobius sera présent à Paris le 16 mai 2014 pour la conférence Franklin Templeton, pous vous inscrire : cliquer ici

Copyright H24 Finance. All rights reserved

DNCA Finance : l'interview "sportive H24"

Episode 7 avec Benjamin Leneutre, Responsable Distribution chez DNCA Finance...

Publié le 25 février 2025

Test 17-02-25

Ceci est une accroche, je souhaite la tester pour voir le rendu live

Publié le 17 février 2025

Votre semaine en un clin d’œil...

Voici vos événements pour la semaine du 13 janvier 2025.

Publié le 13 janvier 2025

Buzz H24

| Pour en savoir plus, cliquez sur un fonds | |

| Lazard Convertible Global | 7.29% |

| M Global Convertibles SRI | 4.43% |